Good time everyone!

Good time everyone!

Modern technologies, of course, are striding forward by leaps and bounds. It got to the point that you can pay for a purchase in a store using a regular phone (and some even manage with a wristwatch!  ). Actually, it was after such one incident (and the surprise of the seller) that I decided to clarify some points ...

). Actually, it was after such one incident (and the surprise of the seller) that I decided to clarify some points ...

And so, if you have an Android phone (I do not consider others in the article), then I would like to inform you that Android Pay payments have been earned in our country not so long ago: i.e. the ability to pay directly from the phone (which, by the way, is translated from English). It should be noted right away that not all phones are equipped with specials. a module that allows this "thing" to work (I will say even more, while not every bank card can be used for this).

Nevertheless, making the phone "money" is quite simple, below I will consider all the nuances ...

*

We make the phone a means of payment (instead of a bank card)

Principle of operation

And so, several years ago, cards for contactless payments (Visa PayWave and MasterCard PayPass technologies) appeared on the banking services market. To distinguish new types of cards from old ones, just look at the front side of the card: there will be an icon in the form of "waves" ("curved lines", see the screen below).

Contactless payment (what the card looks like)

Thanks to the specials. the chip inside these cards - they do not need to be inserted into the POS terminal when purchasing a product. Those. after it is presented to the terminal, it will automatically recognize it and pay (for a small amount - even without a PIN code). Conveniently?!

Classic POS terminal

So, a modern phone with the help of a special. NFC module and softwareAndroid Pay can read the data of your card and subsequently emulate (replace) them when you present it to the terminal. Agree that carrying several bank cards with you is not always convenient (and you can simply forget them), while many have a phone at hand and you can always pay (even when you jumped out of your workplace for lunch).

What banks and cards are suitable

First, your card must support contactless payment technology (i.e. it must have a special badge, see above).

Secondly, not all bank cards can be used for Android Pay yet. Which ones exactly should work:

- "Alfa Bank";

- "Sberbank" (so far only MasterCard (except for the "cut down"));

- B&N Bank (so far only MasterCard);

- VTB (so far only MasterCard);

- "Opening";

- Rosselkhozbank;

- Raiffeisenbank;

- Tinkoff Bank;

- "Qiwi Visa";

- Yandex.Money (MasterCard), etc.

In general, this list is growing rapidly, and I think that soon it will be supported by almost all banks (by the way, the list above was compiled on the basis of personal experience and positive feedback from other users regarding this feature).

How do I know if my phone supports this technology

In principle, this technology is supported by most modern smartphones (unless, of course, budget options are completely excluded). The requirements are quite simple:

- Android version 5.0 or higher;

- the presence of an NFC module;

- the smartphone must not be a "fake" that will not pass the approval of Google services;

- the official version of the phone firmware (no changes via root rights).

Perhaps an ordinary user may have questions only about the NFC module. Below I will try to answer it ...

How to find out if your phone has NFC support:

- pay attention to the user manual (it contains all the capabilities of the device), which comes with the purchase of the phone;

- look carefully at the phone case: as a rule, there should be a sign on a blue background with the letters NFC on the back wall;

- check the phone settings: if it supports this technology, then in the section on working with wireless networks there should be a mention of it;

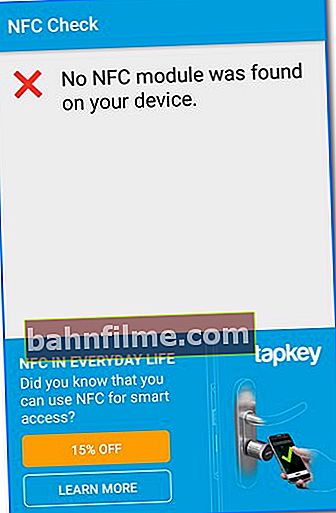

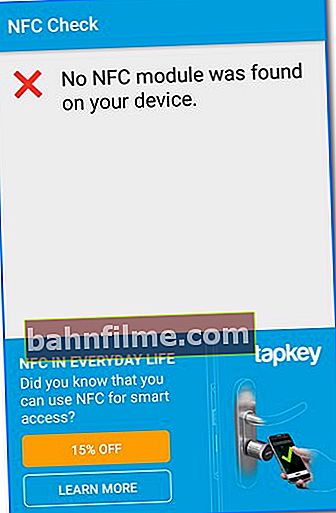

- install the NFC Check application on your phone (link to the Play Market). After starting the application, it will automatically check your device and tell you if there is an NFC module (example below).

The NFC module was not found on your smartphone

How to set up your phone

Not so long ago, I posted a step-by-step instruction on how to add a Sberbank card to Google Pay (to pay for purchases with an Android phone) on the site - //ocomp.info/oplata-kartoy-sberbanka-cherez-google-pay.html

1) The first thing you need to do is check if you have a Google Pay app. If not, then install it by downloading it from the Play Market.

Android Pay app installed

2) Check in the phone settings, in the data transfer (wireless networks) section, whether data exchange is allowed when combining the phone with other devices (see the screen below).

3) Next, in the Google Pay application, click "Add card" and enter its details: name and surname, card number and CVV code (indicated on the back).

Adding a map

4) As a rule, it will be necessary to confirm that you are the owner of this card (it is enough to indicate the code that will come via SMS).

Note! When adding cards of some banks, various incidents may occur: for example, you will see an error that the card cannot be linked, etc. (in this regard, pay attention to the list of banks given above, for which * everything works for sure).

5) It is highly desirable to protect access to the application with a fingerprint or PIN (so that no one can take your phone and make a payment).

How to pay with a phone in a store

And so, you added your bank cards to the phone and everything seems to be set up. Now you can proceed to the tests  ...

...

1) When you come to the payment terminal, pay attention to its appearance, whether it has stickers with the Android Pay logo or a wave-shaped icon. An example of icons is given below.

When can I pay by phone

2) Take the phone out of idle mode and bring it to the terminal (usually leaning the back wall against the glass of the terminal / place for contactless payment). Having held the device in this way for several. seconds - payment must occur.

Payment for purchases by phone

3) Usually, if the payment amount is up to 1000 rubles. (soon they want to make 3000 rubles) - it passes immediately, automatically. If the amount is more, you need to enter the PIN code.

4) If you paid for the purchase by credit card, you may have to sign the check.

5) If you have added several cards to Google Pay, then in the application settings, you must select the one that will be used by default.

Popular questions

1) How much does the service cost, do they charge a commission?

The service works for free, Google does not take any commissions (at least for now  ). You will only pay for the services of the bank that issued your card.

). You will only pay for the services of the bank that issued your card.

2) Is it safe?

Quite! When paying for the purchase, a one-time code is generated, which confirms the transaction. Even if someone intercepts him with the help of "cunning" devices, he will not give him anything. Because you cannot buy it again ...

In addition, you will not have to shine the card itself anywhere, and no one will know its number or CVV code (which, of course, also increases the security of funds on it).

3) Do I need to enter a PIN when paying?

Depends on the amount of payment. Usually, up to 1000 rubles. not necessary (in general, you need to find out this moment from your bank that issued the card).

4) Can the bank block the card if I use Google Pay?

Officially, no one is blocking for this. And personally, I have not come across this either. But in general, if the bank has suspicions that your card is not you and is somehow "wrong" used, it can "freeze" it (and call you back, ask if you have lost the card and if everything is in order. After confirmation from you - everything should work again ...).

5) If I lose my smartphone, will my funds "flow away"?

In general, even without Google Pay, if you lose your phone, you run the risk. funds can also be withdrawn using a regular SMS (if you have a mobile banking service enabled).

To protect yourself, it is highly desirable to block access to the phone using a fingerprint (all modern devices allow you to do this).Then, even if you lose your phone, you will have enough time to block your SIM card and banking products so that no one has time to use them.

I also recommend that you read the article in which I showed how you can delete all data from your phone if you lose it: //ocomp.info/poteryal-telefon-kak-ego-nayti.html

*

Happy settings and good shopping!

That's all for now. Add-ons are welcome ...