Good day everyone!

Good day everyone!

Soon December 1, and before this date it is necessary to pay the tax on the apartment, car, etc. property of the individual. * Actually, that is why I decided that it was time to jot down this note (especially since life itself suggests this topic ...).

*

In general, earlier I received a receipt for my apartment by mail, and paying the tax did not distract me from my usual business. In the same year, September, October, part of November have already passed ... but there is no receipt! Thought ... 👀

It turned out that even without any "manipulations in personal accounts" many are transferred to electronic document management. Of course, the receipt and tax arrears had to be found among the services of state services on their own ... 😉 (I will say right away that they work far from ideal ...).

Now in more detail about how to do it better.

*

* Note!

I am not a lawyer or a financier. Everything that is described in the article is of a philistine point of view, a little personal experience is told (and yes, I could have made some inaccuracies in the interpretations. I apologize in advance).

*

Preview - caricature about the tax service (Evgeniy Kran)

*

Checking your tax debts

👉 STEP 1

First we need TIN number (it looks something like this: 732311885601 (this is a random number)). Even if you do not have a certificate of receipt, you probably have the number itself. You just need to get to know him. 👌

All you need is a passport and a couple of minutes of free time. The link below is for help.

*

👉 Instructions!

How to find out your TIN online (in 1 minute!). How to get a TIN certificate by ordering it online.

*

👉 STEP 2

Further, I highly recommend using a Yandex-money wallet (“YuMani») Or QIWI - you can try to find accruals in them by the TIN number. Unlike a number of banks, they allow you to do this!

(for those who do not have a wallet - I recommend starting it, it helps a lot when solving various small issues)

It is enough to open the section "Payments and transfers" and select the tab "Taxes ..." (screenshots below).

QIWI wallet - check tax debts by TIN number

Yandex money - tax check

Note: if one of the services shows that there are no debts, that's not bad!

However, they do not "see" all charges, and, of course, we will have to check something else ... 👇

*

👉 STEP 3

Next, we need to go and log in 👉 on the website of public services (link to the official resource).

By the way, even if you yourself have not registered there - it is very likely that the profile on you may be there (if recently you have applied somewhere, for example, to "Rosreestr", to "My Documents", etc.).

If so, then, as a rule, a mobile phone will be enough for authorization on the State Services website ... (I will not stop at this anymore, although sometimes registration on this resource can become a quest).

*

At all, the very idea of "Gosuslug" is excellent! Collect everything in one place, so that with two clicks of the mouse you can find out taxes, change your passport, and pay fines! But this does not always work as it should ...

*

Soregarding checking your tax arrears: you must open the tab "Services / Tax and Finance" . 👇

Public services - taxes and finance

Next, you need to follow the link "Tax debt" . 👇

Tax debt

Ideally (if everything has been paid), a message should appear that "There are no tax notifications on the website of state services!" .

but, most often only tax arrears appear on public services! Those. when you see some numbers payable here, it is likely that it will be tax + interest!

There are no notifications from the tax office on the State Services ...

Therefore, it will also be necessary to check the website of the Federal Tax Service (in fact, for this we need authorization to public services - since registering on the FTS website is much more difficult than going to it using government services! 👌).

*

👉 STEP 4

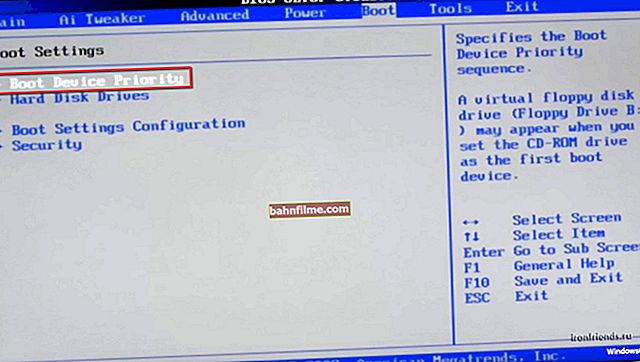

Now go to the FTS website (link to the official resource). Next, we open the personal account of an individual.

Screenshot from the FTS website - go to the personal account of the physical. faces

The easiest way to log in (and the most working, unlike other methods) is through website of public services ... That is why I added the previous step to the article. 👇

Login through the website of public services

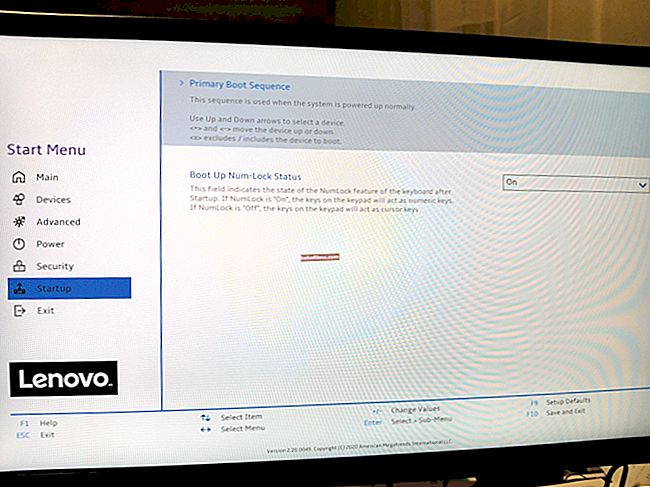

By entering your personal account and opening the tab "Taxes" - you finally see all your notifications and receipts (which, for some reason, are not displayed on public services 👀).

Property tax - receipt found!

*

👉 STEP 5

By the way, as far as payment is concerned, it's best open tax notice, find in itbarcode (QR code) and pay with it using a smartphone (payment with a card on the FTS website for me, for some reason, also did not work - the wheel "spins", and the page does not load ...).

👉 To help!

Payment by QR code: how to scan it and make a payment from your phone

Open receipt

*

PS

Either it seems to me, or it seems, or the mail is swaggering over me ...

But oddly enough, you can check the tax debt at the "Russian Post" (just today they sent me a message).

But I have a suspicion that they work as a site. "State services" - they will see the debt when it is already together with the penalty ... (but I didn’t check it myself, I don’t presume to assert)

Message from "Russian Post"

*

So far, everything seems to be on the sim ...

Add-ons on the topic are highly welcome!

Good luck and don't get caught!

😉